KD:指標 台指實驗

在這篇文章中,將示範三種策略 :

1:K值向上穿越D值(黃金交叉)時做多,K值向下穿越D值(死亡交叉)時多單平倉。

KD策略1:

K值向上穿越D值(黃金交叉)時做多,K值向下穿越D值(死亡交叉)時多單平倉。

策略名稱 | KD策略1 |

交易層級 | 1日 |

交易成本 | 來回600 |

回測期間 | 2001-2019/2 |

權益曲線:

程式碼:

Var :

RSV(50) ,

K_(50) ,

D_(50) ;

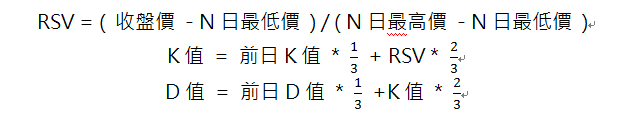

RSV = (c-Lowest(l,9))/(Highest(h,9)-Lowest(l,9))*100 ;

K_ = K_*2/3 + RSV*1/3 ;

D_ = D_*2/3 + K_*1/3 ;

//Gold Cross Buy

if marketposition<=0 and K_ cross above D_ then

buy 1 share at next bar market ;

//Dead Cross Sell

if marketposition>0 and K_ cross below D_ then

sell all shares at next bar market ;

if dayofmonth(date)>14 and dayofmonth(date)<22 and dayofweek(date)=3 and time>=1330 and time<=1345 then begin

sell("CheckDay Sell") all shares at this bar close ;

buytocover("CheckDay Buytocover") all shares at this bar close ;

end ;

KD策略2:

K值和D值處於超賣區(<20)時做多,K值和D值處於超買區(>80)時多單平倉。

策略名稱 | KD策略2 |

交易層級 | 1日 |

交易成本 | 來回600 |

回測期間 | 2001-2019/2 |

程式碼:

Var :

RSV(50) ,

K_(50) ,

D_(50) ;

RSV = (c-Lowest(l,9))/(Highest(h,9)-Lowest(l,9))*100 ;

K_ = K_*2/3 + RSV*1/3 ;

D_ = D_*2/3 + K_*1/3 ;

//OverSelling Buy

if marketposition<=0 and K_<20 and D_<20 then

buy 1 share at next bar market ;

//OverBought Sell

if marketposition>0 and K_>80 and D_>80 then

sell all shares at next bar market ;

if dayofmonth(date)>14 and dayofmonth(date)<22 and dayofweek(date)=3 and time>=1330 and time<=1345 then begin

sell("CheckDay Sell") all shares at this bar close ;

buytocover("CheckDay Buytocover") all shares at this bar close ;

end ;

以損益圖就可以發現,這存在交易次數太少的問題,並且跟策略1一樣,在2009年之前表現得並不好;總體來說,並不是一個好的策略。

KD策略3:

用RSV寫出改良版的簡單策略;N改為55,RSV>65時做多,RSV<10時多單平倉

策略名稱 | KD策略3 |

交易層級 | 1日 |

交易成本 | 來回600 |

回測期間 | 2001-2019/2 |

程式碼:

Input :

len(55) ,

L_in(65) ,

L_out(10) ;

Var :

RSV(50) ;

RSV = (c-Lowest(l,len))/(Highest(h,len)-Lowest(l,len))*100 ;

if marketposition<=0 and RSV>L_in then

buy 1 share at next bar market ;

if marketposition>0 and RSV<L_out then

sell all shares at next bar market ;

if dayofmonth(date)>14 and dayofmonth(date)<22 and dayofweek(date)=3 and time>=1330 and time<=1345 then begin

sell("CheckDay Sell") all shares at this bar close ;

buytocover("CheckDay Buytocover") all shares at this bar close ;

end ;

以損益圖可以發現,策略3比前兩個策略都好得多,程式碼也不會很難、比前面兩個策略的都還要簡單;筆者把策略績效放在後面,提供給讀者練習。

邏輯中文翻譯: